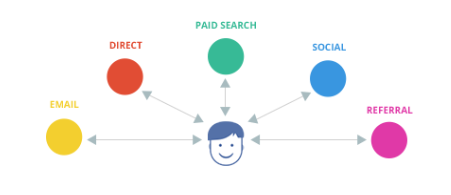

With customer buying behaviour continuously evolving, and the increasing power of social media, mobile and other web-based exchanges, online travel brands are forced to constantly adjust and refine their marketing strategies. Recently Google Think Insights created an interesting tool meant to shed some light on how the different marketing channels affect today’s online customer along the decision making-journey.

Google analysed over 36,000 Google Analytics accounts with enabled eCommerce tracking, in order to understand the role played by the various online marketing channels towards purchase decisions. The study plots data for 11 different industries, travel included, as well as 7 different countries.

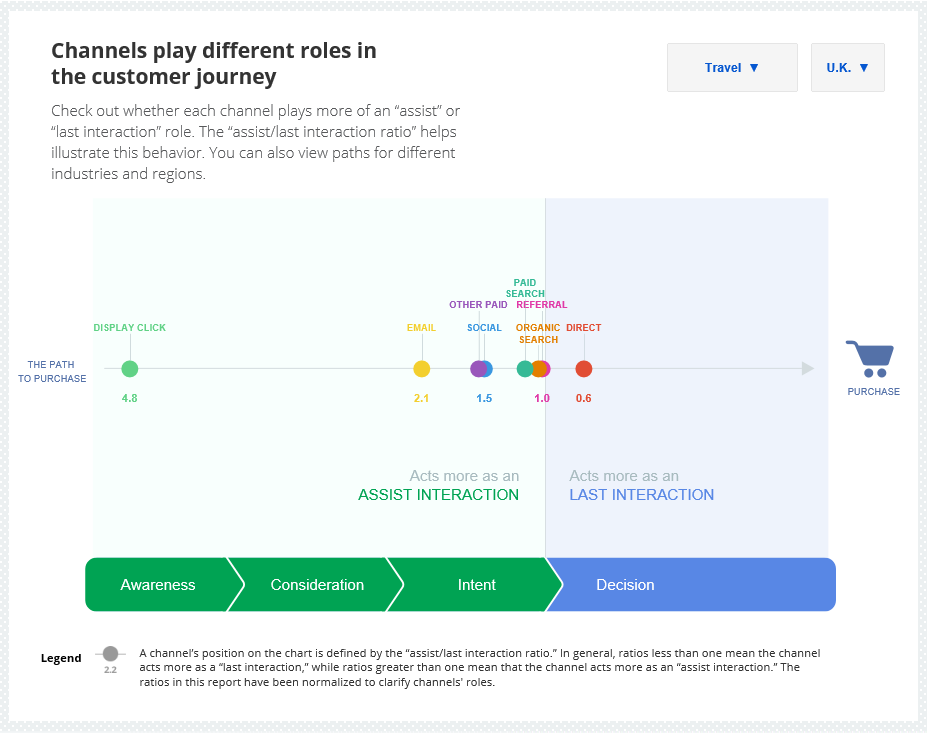

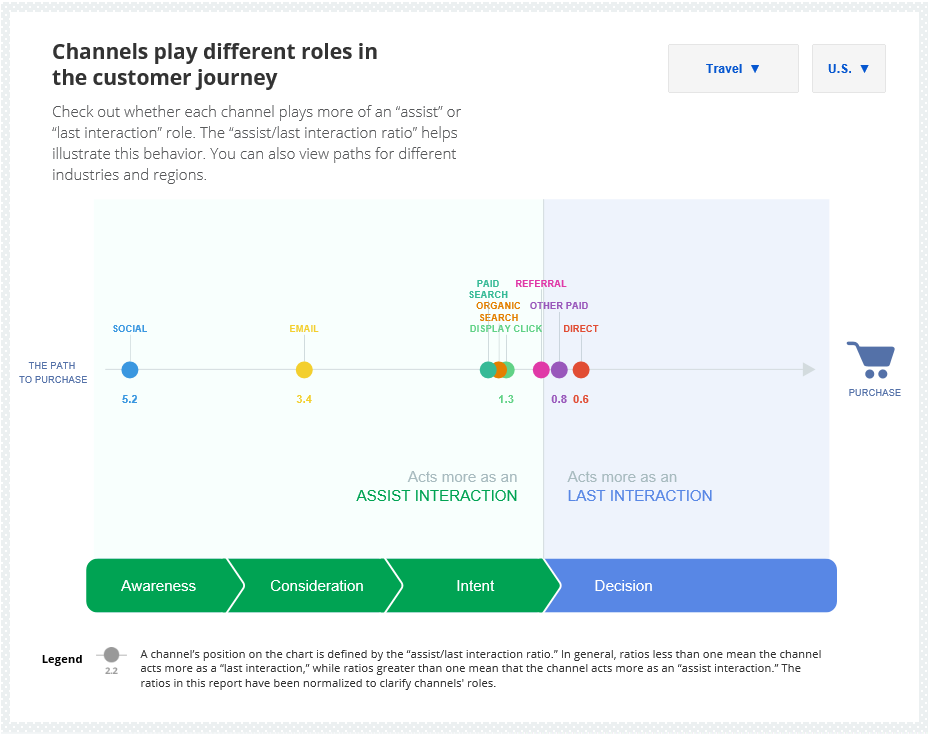

According to Google’s research, in the customer purchase path different marketing channels such as email, social media, display ads, direct search, referrals, paid and organic search will add different values to the customer at different stages. Some channels will act more as an assisting interaction, i.e. by building brand awareness – these are the channels which make a customer consider a brand earlier in the purchase funnel; while others will act further downstream, when the customer’s decision and transaction, is made.

On the study a channel’s position is defined by what Google calls an “assist/last interaction ratio”. In general, ratios of less than one mean the channel will act more as a last interaction towards final decision and purchase, while ratios greater than one mean the channel acts more as brand awareness and consideration.

When you compare the different industries and/or countries, the tool clearly shows how customers behave differently and respond differently to the various online channels interactions. For instance, on the first chart below, insights on the decision-making cycle across the UK travel market are shown, while the second chart focuses on the same decision-making cycle, but this time in the US market.

Chart 1 – Customer online influence path for Travel, UK.

Chart 2 – Customer online influence path for Travel, USA.

When comparing the above charts, the points of influence are significantly different for the two markets. For the UK market, both social media (1.5) and email (2.1) seem to play a more significant role upstream on the intent stages of the customer purchase funnel, when compared to the US market, where social media scores (5.2) and email (3.4). By contrast on the US market, other paid channels (0.8) are considered to play a bigger tactical role when compared to the UK (1.5). You can compare a full scope of industries and countries on Google’s Think Insights original study on the customer journey to online purchase.

Considerations

Whether you work in travel, or in any other industry, you may find these results to fit or not with your past and current experience; however, the most interesting takeaway from this study is that now you can have a benchmark for you to measure up against, considering not only your industry but also the different markets. And since social media, email, search engine optimization and other digital marketing tactics can be all too easily put in the same basket, it’s rather refreshing to have a visual tool which allows the comparison between the different channels impact.

Want to know what HotelREZ can do for your Hotel?

HotelREZ Hotels & Resorts is a hotel representation company providing distribution, sales and marketing consultancy and technology to independent hotels and small chains. We provide properties with GDS representation under our own HO chain code, and help market hotels to thousands of travel and MICE agents and partners worldwide. For more information on joining our portfolio of unique and independent hotels contact our Business Development team today or complete our hotel membership enquiry form.

Images courtesy of Google Think Insights.